AI in Banking A Guide to Financial Transformation

Explore how AI in banking is revolutionizing financial services. Our guide covers real-world use cases, core technologies, and strategic implementation.

Artificial intelligence isn't some far-off idea you see in sci-fi films anymore. It's happening right now, reshaping the banking world, particularly here in Germany. Think of it less like a minor software update and more like the arrival of the internet—a complete change in how banking gets done.

The New Reality of AI in German Banking

If you're wondering what the future of finance looks like, just look around. AI has officially left the lab and is now a core part of the German banking sector, overhauling everything from the ground up. This isn't just about bolting on a few new tech features; it's a fundamental rethink of how banks operate.

The integration of AI in banking is changing how you interact with your bank, how quickly complex back-office tasks get done, and how your money is protected from ever-smarter threats.

We're seeing major financial institutions across Germany and Europe putting serious money into this, which tells you everything you need to know about where the industry is heading. For instance, Finanz Informatik, the tech arm for the Savings Banks Finance Group, is already expanding its on-premise AI factory. Their goal? To automate routine jobs and make better sense of all the banking data they handle. It’s a clear sign that this is no longer optional.

Core Themes of the AI Revolution in Finance

As we watch this shift unfold, three big ideas keep coming up. They're essentially the pillars on which modern banks are building their future:

- Achieving Operational Excellence: AI is fantastic at handling the repetitive, high-volume stuff—think data entry, compliance checks, or answering basic customer queries. This frees up the human experts to focus on the tricky, strategic work that really makes a difference.

- Delivering Hyper-Personalised Customer Journeys: By digging into vast amounts of data, AI helps banks move past one-size-fits-all services. Instead, they can offer product recommendations, financial advice, and support that feel like they were designed just for you.

- Building Unbreachable Security: Intelligent systems are brilliant at spotting fraud and cyber threats in real-time. They can catch subtle patterns that a human analyst might miss, which ultimately makes banking safer for everyone.

This is about more than just being efficient. It’s about creating a bank that's stronger, more responsive, and genuinely puts its customers first. The banks that get this right will be the ones setting the standard for years to come.

Getting started on this journey requires a clear vision and a solid plan. For any organisation looking to map out its first steps and see how these themes fit their unique situation, our experts in AI strategy consulting can help point the way. By taking a strategic approach, banks can turn the massive potential of AI into real, market-leading advantages. The change is happening, and now is the time to get involved.

Understanding the Technologies Powering Banking AI

To really get a feel for how AI is changing the banking world, it helps to pop the bonnet and see what’s running the show. These aren't just buzzwords; they're specific tools doing specific jobs, all working together to make financial services smarter and more intuitive. Let’s break down the main players with some straightforward analogies.

Machine Learning: The Digital Detective

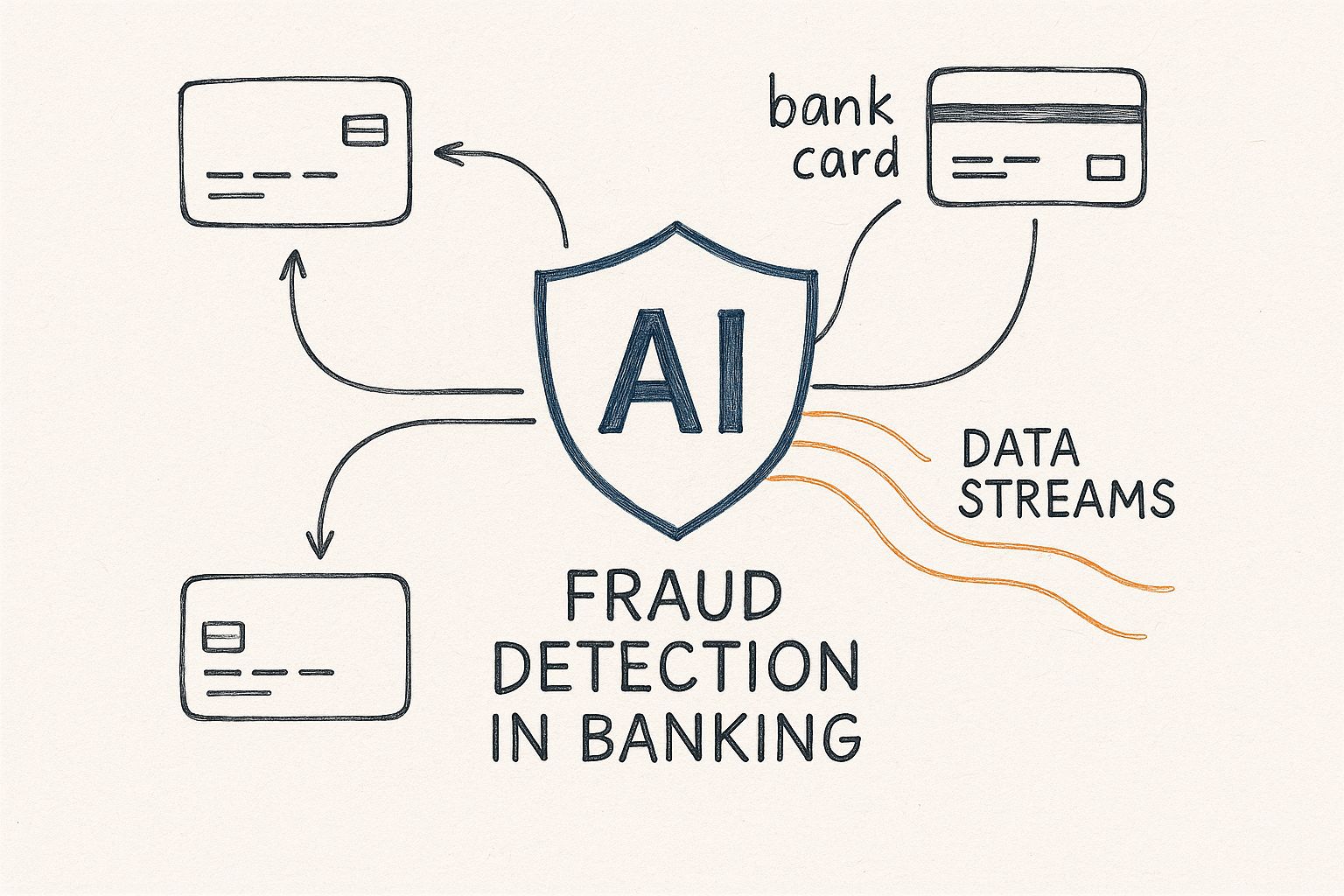

Picture a veteran fraud detective who has spent a lifetime studying case files, developing an uncanny sixth sense for what looks suspicious. That's a great way to think about Machine Learning (ML). It’s a field of AI where systems learn from huge amounts of data to spot patterns and make predictions, all without someone having to write rules for every single possibility.

In a bank, an ML model sifts through millions of transactions as they happen. It quickly learns what "normal" spending looks like for you. So, when a transaction suddenly pops up that doesn't fit your usual pattern—maybe a large purchase in a city you've never visited—the system flags it instantly. It's far faster and often more accurate than a human team could ever be.

As you can see, the AI essentially acts as a command centre, taking in all sorts of data points and turning them into a coordinated, intelligent shield that protects a bank’s assets and its customers.

Natural Language Processing: The Skilled Diplomat

Think of Natural Language Processing (NLP) as a brilliant translator or a skilled diplomat for computers. It’s the technology that gives machines the power to understand, interpret, and respond to everyday human language, whether it’s written down or spoken aloud. This goes beyond just recognising words; it’s about grasping the context, the intent, and even the emotion behind them.

This is the magic that makes modern chatbots and virtual assistants so useful. Instead of typing rigid, pre-set commands, you can just ask your banking app, "What was my biggest spend last month?" Thanks to NLP, the system understands what you’re really asking for and pulls up the right information, making the whole experience feel much more natural.

Generative AI: The Creative Co-pilot

Generative AI is the newest and, for many, the most exciting player on the field. If ML is the detective and NLP is the diplomat, then Generative AI is like having a creative co-pilot by your side. It doesn't just analyse the data it’s given; it can create brand-new, original content based on what it has learned.

The potential here for banking is immense. A Generative AI system could:

- Draft detailed market analysis reports for investment teams in minutes.

- Write personalised marketing emails that speak directly to an individual's financial situation.

- Summarise dense, complex regulatory documents into a few clear takeaways for compliance officers.

Generative AI represents a shift from simple task automation to genuine human augmentation. It gives banking professionals the tools to be more strategic, creative, and efficient.

To tie this all together, here is a quick summary of these core technologies and how they're being put to work in the financial sector.

Core AI Technologies and Their Banking Applications

AI Technology Simple Analogy Primary Banking Application

Machine Learning (ML)

The Data Detective

Spots fraud, calculates credit scores, and assesses risk by finding hidden patterns in financial data.

Natural Language Processing (NLP)

The Expert Translator

Powers smart chatbots and voice assistants that understand and answer customer questions in a natural way.

Generative AI

The Creative Co-pilot

Creates personalised marketing materials, drafts financial reports, and writes customer communications automatically.

It's important to remember that these technologies don't operate in a vacuum. In fact, they're most powerful when they work together. A customer might start by talking to an NLP-powered chatbot, which then uses an ML model to check for unusual account activity, and finally uses Generative AI to compose a clear, helpful, and personalised response. This seamless integration is what truly defines the impact of modern AI in banking.

So, we’ve covered the core technologies. But what does it all mean for a bank’s bottom line and day-to-day operations? This is where theory meets reality. Adopting AI isn't just about chasing the latest tech trend; it's about fundamentally solving old problems in new ways and unlocking genuine business value.

When you pull back the curtain, you’ll find that AI acts as a powerful catalyst for change in four crucial areas, reshaping how financial institutions function and compete.

Unlocking Supercharged Operational Efficiency

Every bank contends with mountains of repetitive, manual work that drains time and money. Think about data entry, document verification, or routine compliance checks. AI is brilliant at automating these exact workflows. This automation liberates your most skilled people from monotonous tasks, freeing them up to focus on what humans do best: strategic thinking, complex problem-solving, and building real client relationships.

Take a major German bank, for instance, that decided to automate its loan application process. What used to be a days-long manual slog of data validation became a task an AI system could handle in minutes. The results were immediate: faster loan approvals, operational costs slashed by over 30%, and loan officers who could now spend their time on more intricate cases.

Gaining Superior Fraud Detection and Risk Management

In the high-stakes world of finance, you always need to be one step ahead of the criminals. Traditional, rule-based security systems are often too rigid and slow to catch today’s sophisticated fraud schemes. This is where AI, especially machine learning, completely changes the game. It learns from vast amounts of historical data to spot and predict threats before they can do any real harm.

AI doesn't just react to fraud; it anticipates it. By analysing millions of transactions in real-time, it can spot subtle anomalies that would be invisible to human analysts, providing a proactive layer of security.

Consider a Frankfurt-based institution that brought in an AI-powered transaction monitoring system. The system quickly learned what "normal" customer behaviour looked like and started flagging suspicious activity with incredible accuracy. Within just six months, the bank reported a 60% drop in fraudulent losses, protecting its assets and, just as importantly, its clients' trust.

Crafting Hyper-Personalised Customer Experiences

Today’s customers have come to expect services that feel like they were made just for them. AI gives banks the ability to move past generic, one-size-fits-all offerings and deliver truly hyper-personalised experiences. By analysing customer data—from transaction history and browsing habits to service interactions—AI can anticipate what a customer needs and present the right product or piece of advice at the perfect time.

Imagine a customer logging into their mobile banking app. Instead of seeing the same old standard dashboard, they get a personalised insight: "We noticed you've been saving for a trip. Here's a travel-focused credit card with no foreign transaction fees." This kind of proactive, tailored interaction makes customers feel seen and valued, which is a massive driver for loyalty.

Simplifying Regulatory Compliance

For any bank, navigating the dense and constantly shifting maze of financial regulations is a significant challenge. AI-powered tools can automate much of this burden, from monitoring transactions for compliance with anti-money laundering rules to analysing new regulations and generating reports for authorities. This not only minimises the risk of human error and eye-watering fines but also makes the entire compliance function far more efficient.

Of course, reaping these rewards requires a solid plan. For any institution looking to translate these possibilities into a concrete roadmap, exploring a proven AI strategy framework is the next logical step toward successful implementation and real value creation.

How German Banks Are Winning with AI Today

Theory is one thing, but seeing AI in banking deliver real results is something else entirely. Across Germany, financial institutions are well past the hypothetical stage. They're actively using intelligent systems to solve genuine business problems, and these aren't small-scale experiments—they are strategic moves that are creating tangible value right now.

Here, we shift from the 'why' to the 'how', looking at concrete real-world use cases where AI is making a noticeable difference. From empowering staff to bolstering physical security, German banks are proving that a well-aimed AI strategy really does pay dividends. The key, as we explored in our AI adoption guide, is picking the right application to start with. These examples paint a clear picture of what that looks like in practice.

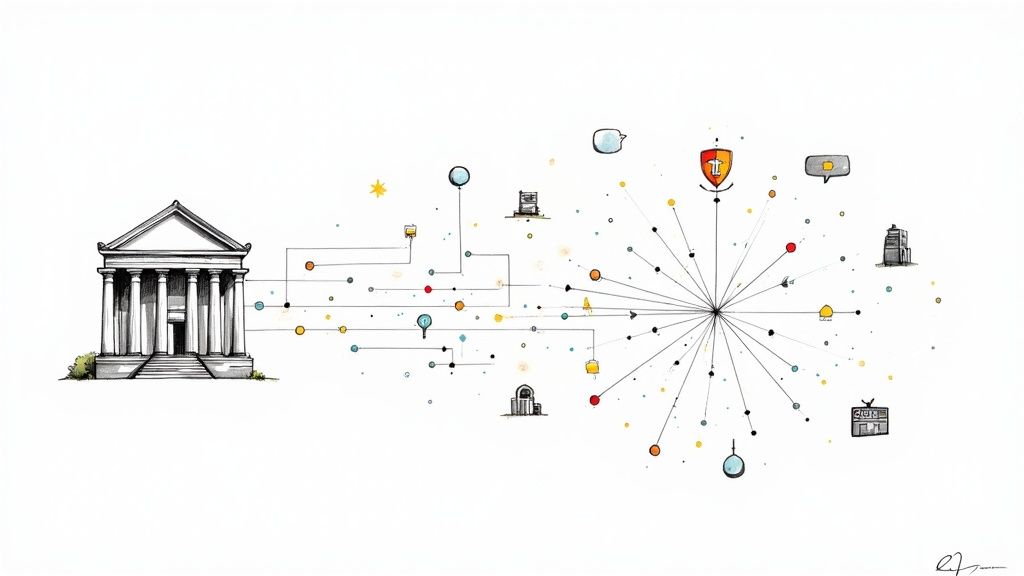

Strategic Investment in Advanced Language Models

Leading the way, Deutsche Bank made a serious statement by investing in Aleph Alpha, a German AI firm that specialises in large language models. This partnership shows that major players see advanced AI not just as an efficiency tool, but as a critical piece of their future competitive edge. Their goal is to build sovereign AI solutions capable of handling sensitive financial data while complying with Europe’s stringent data privacy laws.

This isn't about a single application; it’s a strategic investment in foundational technology that can be woven throughout the entire organisation. The potential uses are vast:

- Sophisticated document analysis: Automating the tedious, time-consuming review of complex legal contracts and dense financial reports.

- Enhanced client communication: Developing smart assistants that can offer nuanced, context-aware advice to customers.

- Internal knowledge management: Creating a powerful internal search engine that helps employees instantly find information buried in the bank’s sprawling databases.

Empowering Employees with AI Assistants

In Frankfurt, the private bank B. Metzler has taken a different, yet equally powerful, path. They partnered with a Swiss AI fintech to create and launch MetzlerGPT, an internal AI assistant built to support their 800 employees. It essentially acts as a co-pilot, helping staff with everything from digging into data to drafting emails and reports.

Instead of trying to replace human insight, MetzlerGPT enhances it. The assistant gives staff instant access to information, which frees them up to work faster and concentrate on the more strategic, high-value parts of their jobs. It’s a perfect example of a core principle in successful AI adoption: the technology should make your people better, not just automate them out of a role.

This approach of augmenting employees is a fantastic model for AI integration. It boosts productivity, improves job satisfaction, and helps build a workforce that is truly comfortable and skilled with next-generation tools.

Innovating Security with Intelligent Surveillance

AI's role in banking isn't just confined to the digital realm; it's also being put to work in the physical world. Sparkasse Suedwestpfalz offers a great example with its deployment of KeBob, an AI-powered system for security and fraud prevention. This intelligent system watches the areas around bank premises and ATMs, using computer vision to spot unauthorised or suspicious activity.

The system is trained to recognise unusual patterns—like someone loitering for too long or trying to tamper with a machine. When it detects something amiss, it can trigger an immediate alert, allowing for a swift security response. This proactive stance on security is a huge leap forward from the traditional, reactive methods of surveillance.

These varied examples reveal a dynamic and maturing AI ecosystem within Germany's banking sector. From big-picture investments in core technology to practical tools that support employees and secure property, these institutions are proving the real-world value of a focused AI implementation. Those inspired by these success stories might find that a solid AI strategy consulting plan is the perfect first step toward building their own.

Navigating the Hurdles of AI Implementation

Embarking on an AI journey is exciting, but it’s crucial to go in with your eyes open. While the promise of AI in banking is enormous, the path isn't always smooth. Let's be realistic—there are challenges. Acknowledging them upfront is the best way to avoid getting derailed later on.

Most of the obstacles you'll face fall into four main categories: data privacy concerns, the initial price tag, finding the right people, and wrestling with old technology. Getting a handle on these issues is the first real step toward creating an AI strategy that actually works and delivers value for years to come.

Tackling Data Privacy and Regulatory Compliance

In finance, an industry built on trust and regulation, data privacy is everything. You simply can't afford to get it wrong. Strict frameworks like Europe's General Data Protection Regulation (GDPR) set firm rules for how you can handle customer data. Since AI models need massive amounts of data to learn, they have to be built from the very beginning with these rules in mind.

This is where the 'Privacy by Design' philosophy comes in. It’s not about bolting on compliance features at the end; it's about weaving data protection directly into the fabric of your AI systems and processes. This proactive stance doesn't just keep the regulators happy—it builds and maintains the customer trust that is, without a doubt, a bank's most precious asset.

Managing High Initial Costs and ROI

Let’s be blunt: implementing AI costs money. A lot of it. You're looking at expenses for powerful hardware, specialised software, and the people needed to build and train the models. For many banks, that initial financial hit can be a serious roadblock.

The key to getting past this is to build a rock-solid business case with a clear return on investment (ROI). Don't try to boil the ocean. Start with smaller projects that target a specific, high-impact problem. Quick wins not only prove the technology's value but also build the confidence and momentum you need to get stakeholders on board for bigger, more ambitious plans.

Overcoming the AI Talent Shortage

One of the toughest and most persistent challenges is finding people who know what they're doing. There’s a serious shortage of skilled data scientists and machine learning engineers, especially those who also understand the complexities of the financial world. This talent gap can really slow you down and make it hard to scale up your AI efforts.

Instead of just trying to outbid competitors for a handful of experts, a smarter, more sustainable strategy is to grow your own talent. Investing in upskilling and reskilling programmes can give your current employees the AI skills you'll need tomorrow.

Developing your team from within creates a more loyal and deeply knowledgeable workforce. If you're wondering how to structure such a programme, our hands-on AI strategy workshop is designed to help organisations build exactly these kinds of internal capabilities.

Integrating with Legacy Systems

Finally, there's the elephant in the room for many established banks: ancient IT systems. Trying to plug a sleek, modern AI platform into a decades-old legacy infrastructure can feel like a technical nightmare. These older systems are often rigid and don't make data easy to access, creating a major bottleneck for any AI project.

The most practical solution here is a phased approach. By using APIs and other middleware, you can build a bridge between your old and new systems. This allows you to modernise gradually without having to shut down or disrupt the core banking operations your customers rely on every day.

The Future of Banking and Your Strategic Next Steps

If you think AI is just about back-office optimisation, it’s time to look again. The future of banking isn't just about using AI to do things faster; it's about fundamentally reshaping the relationship between a bank and its clients. We're moving away from AI as a simple tool and towards AI as a core partner in finance, one that can redefine trust, purpose, and what a bank truly is. This isn't about just keeping up with change—it's about getting out in front of it.

Getting there takes more than just buying the latest software. It's about building a solid, scalable foundation for intelligence. Many industry leaders call this an 'AI factory'—a system for developing and deploying smart solutions securely and at scale. This isn't some far-off dream, either. The artificial intelligence market in German banking, for instance, is already on a steep growth curve, with projections pointing towards a market size of $8.2 billion by 2030. This explosive growth underscores just how central AI is becoming. You can explore a deeper analysis of the future of AI in German finance to see the numbers for yourself.

Emerging Trends on the AI Horizon

So, what’s next? The next wave of financial AI is already here, guided by a few powerful trends. These aren't abstract ideas; they are the strategic pillars that the most forward-thinking banks are building on right now.

- Explainable AI (XAI) for Building Trust: When an AI model approves or denies a loan, everyone involved—from the customer to the regulator—will want to know why. That’s where Explainable AI comes in. XAI peels back the layers of the "black box," making the machine's reasoning transparent and understandable. In a world of automated decisions, this is non-negotiable for maintaining trust.

- AI-Powered ESG Investing: Environmental, Social, and Governance (ESG) factors are no longer a niche concern; they're at the heart of modern investment strategies. AI is uniquely capable of sifting through mountains of unstructured data—think news articles, social media sentiment, and corporate reports—to generate far more accurate and nuanced ESG scores. This helps investors put their money where their values are.

- The Predictive Financial Partner: This is the ultimate goal: a bank that’s less of a vault and more of an intelligent co-pilot for your financial life. Imagine your banking app doing more than just showing you a balance. Picture it offering genuinely helpful, proactive advice: "Based on your current spending, you're set to hit your savings goal two months early," or "A home similar to yours just sold nearby; now could be a great time to reassess your mortgage."

This shift moves the bank from being a reactive service provider to a proactive, intelligent partner in a client's financial life. It’s about anticipating needs before the customer even realises them.

Charting Your Course for Long-Term Success

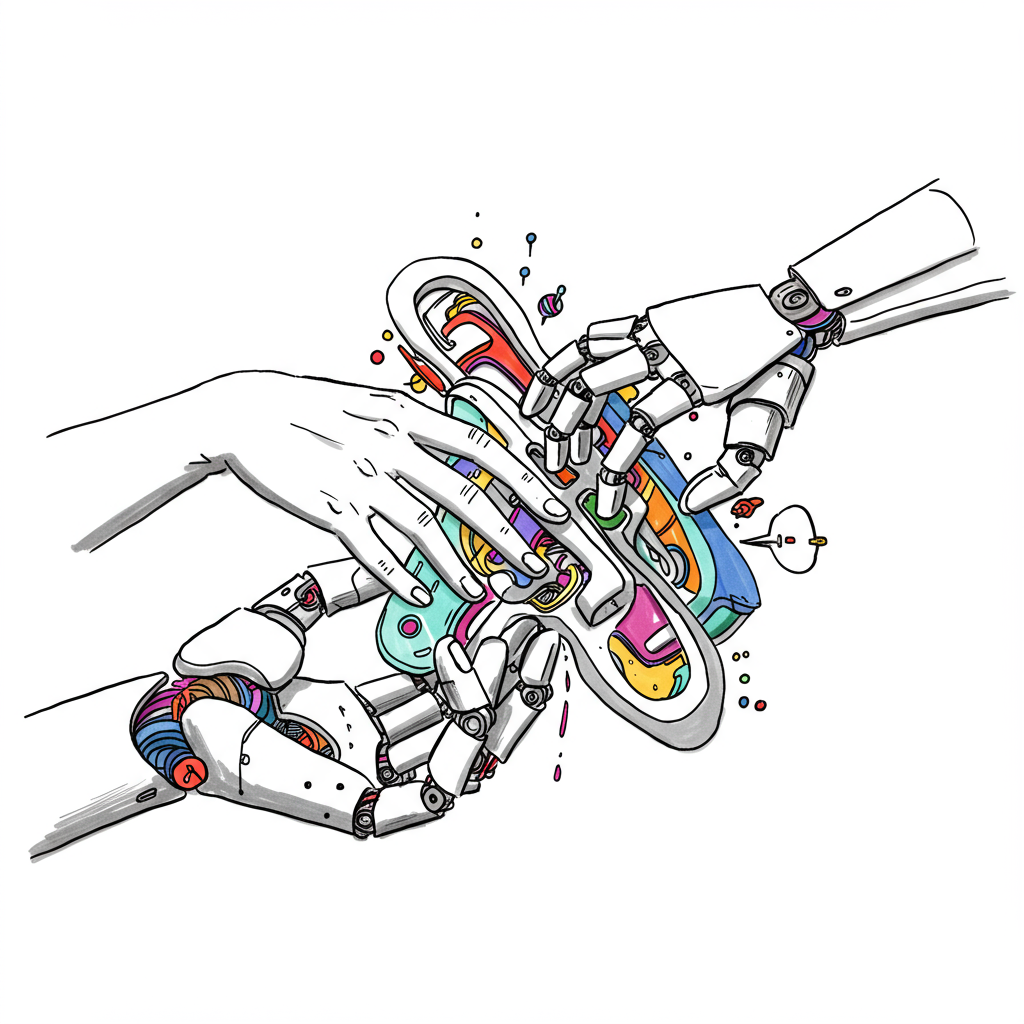

Navigating this new world requires a clear plan and the right expertise. The sheer complexity of these applications means that the go-it-alone approach is quickly becoming obsolete. The smartest banks are now turning to AI co-creation, working hand-in-hand with specialists to design, build, and launch the next generation of financial solutions.

Before you can move forward, you need to know where you stand. A frank self-assessment is the first, most crucial step. Our AI Strategy consulting tool was built for exactly this purpose—to help you gauge your organisation's readiness and pinpoint the opportunities with the highest impact. By pairing strategic foresight with the right technology, you can map out a path that doesn't just keep up with the industry but helps lead it.

When you’re ready to turn these big ideas into real-world results, connect with our expert team. Let’s build the future of your financial institution, together.

Accelerate Your AI Journey with an Expert Partner

The writing is on the wall: AI is fundamentally reshaping the banking industry. While the opportunities are immense, seizing them requires careful and strategic planning. Adopting a forward-thinking approach isn't just a nice-to-have anymore; it’s absolutely essential for staying relevant in this new financial world. Now is the time to act.

Of course, navigating the maze of strategy, technology, and implementation is a huge undertaking. The hurdles are very real, from ensuring data security to finding the right talent. The good news? You don't have to go it alone. Partnering with specialists can fast-track your progress, reduce the risks of your investment, and make sure you're building on a rock-solid foundation.

From Vision to Value

Getting from a bright idea about AI to seeing real, measurable results takes a specific mix of deep industry knowledge and sharp technical skill. The right partnership can guide you confidently through every stage, from the initial brainstorming sessions all the way to a full-scale rollout.

An approach like AI co-creation ensures the solutions you develop aren't just technically impressive, but are also perfectly matched to your unique business goals. This kind of synergy is what turns ambitious ideas into tangible returns that genuinely strengthen your position in the market.

This isn't just about finishing a single project. It's about building a lasting capability. The goal is to embed intelligence right into the heart of your organisation, creating a bank that's nimble, insightful, and truly puts its customers first.

Charting Your Path with Confidence

Let's be honest, that first step is often the hardest. To build a solid strategy, you first need to get a clear picture of where you stand today and then identify the opportunities that will deliver the biggest impact.

There are frameworks and tools designed specifically to bring this kind of clarity.

- A well-defined AI strategy framework can give you the roadmap you need for a successful implementation.

- An AI Strategy consulting tool can help you self-assess your readiness and pinpoint high-value areas to start with.

- A thorough AI requirements analysis is crucial for defining your project scope and avoiding common pitfalls down the road.

- Exploring real-world use cases can also spark new ideas and offer practical insights.

We invite you to connect with our expert team to talk through your specific challenges and ambitions. Let's work together to build the future of your financial institution.

Ready to transform your business with a clear AI strategy? At Ekipa AI, we deliver tailored AI strategies in 24 hours. Start your AI transformation journey today.