AI in Insurance Changes Everything

Discover how AI in insurance is transforming underwriting, claims, and customer service. Explore real-world use cases and a roadmap for successful AI adoption.

Imagine an insurance industry that can spot a potential risk before it turns into a disaster or settle a claim in minutes instead of weeks. This isn't a glimpse into a distant future; it's what's happening right now, all thanks to AI in insurance. The industry is finally moving away from its old, paper-shuffling, reactive self and becoming a smarter, data-first operation.

The New Reality of an AI-Powered Insurance Industry

For generations, the insurance world has been stuck in its ways—defined by manual underwriting, mountains of paperwork, and long, drawn-out timelines. Everything from writing a new policy to processing a claim depended on historical data and human gut feelings. This old-school approach created frustrating delays for customers and massive operational headaches for insurers.

Now, artificial intelligence is rewriting the rulebook. AI isn't just another tool; it's a strategic partner that allows insurers to get ahead of events instead of just cleaning up after them. It’s not about replacing experienced professionals but about amplifying their skills, freeing them from tedious administrative work to focus on what humans do best: handling complex judgments and building relationships.

A Shift From Reactive to Proactive Operations

The most significant change AI in insurance brings is the move from a reactive to a proactive mindset. Instead of just waiting for a claim to land on their desk, insurers can use AI to analyze real-time data from various sources—like weather patterns or IoT sensors—to flag risks and even prevent losses from happening in the first place.

This is more than just an efficiency play. It's about building a more resilient, customer-centric industry.

Speed and Precision: AI algorithms can sift through enormous datasets in the blink of an eye. The result? Faster quotes, quicker claim settlements, and far more accurate risk assessments.

A Better Customer Experience: By automating the routine stuff, AI lets human agents step in where they're needed most, providing personalized advice and empathetic support during stressful times.

Truly Data-Driven Decisions: Decisions can now be based on predictive insights, not just historical averages. This leads to fairer, more individualized pricing and smarter overall risk management.

This fundamental shift is fueling explosive market growth. The global AI insurance market was valued at around $4.59 billion in 2022. It's projected to skyrocket to nearly $79.86 billion by 2032, which is a compound annual growth rate of 33.06%. This incredible expansion, as detailed in reports on the insurance market’s rapid AI adoption, highlights just how central AI has become to the industry's future.

At its heart, AI allows the insurance industry to fulfill its original promise on a scale never before possible: to provide a reliable safety net that is both fair and fast, adapting to the individual needs of every policyholder.

To truly grasp this evolution, it's helpful to break down the specific technologies at play. Each one serves a distinct purpose, working together to modernize the entire insurance value chain.

Core AI Technologies Transforming Insurance

Here’s a quick look at the key AI technologies and the roles they play:

AI Technology | Core Function in Insurance | Example Application |

|---|---|---|

Machine Learning (ML) | Analyzes vast datasets to identify patterns, predict outcomes, and make data-driven recommendations. | Predicting claim fraud by spotting unusual patterns in claim submissions. |

Natural Language Processing (NLP) | Understands, interprets, and generates human language from text and speech. | Powering chatbots that answer customer questions 24/7 or analyzing claim notes. |

Computer Vision | Extracts information and insights from images and videos. | Assessing vehicle damage from photos after an accident for instant claim estimates. |

Robotic Process Automation (RPA) | Automates repetitive, rule-based digital tasks. | Automating data entry from application forms into core insurance systems. |

Generative AI | Creates new, original content, such as text, images, or code, based on learned patterns. | Drafting personalized customer communications or summarizing complex policy documents. |

Understanding these tools is the first step. In this guide, we'll explore how they are being applied in the real world—from underwriting and claims to customer service. For any professional hoping to stay relevant, getting a handle on these changes is non-negotiable. As we'll see, a successful journey often starts with a clear roadmap, which is why many carriers begin with AI strategy consulting to pinpoint where technology can make the biggest impact.

How AI Is Reshaping Underwriting and Risk Assessment

Underwriting has always been the analytical heart of the insurance world. It’s a delicate balancing act of weighing probabilities to decide if a risk is worth taking. For decades, this meant an underwriter acted like a meticulous detective, poring over a handful of clues—application forms, driving records, and old claims—to make a judgment call. This traditional method worked, but it was slow, labor-intensive, and often relied on broad, sometimes unfair, generalizations.

Enter AI. It completely flips the script. An AI-powered system isn't just a detective with a magnifying glass; it's a quantitative researcher with a supercomputer. Instead of being stuck with a few static documents, AI algorithms can instantly analyze a vast, ever-changing universe of information. This builds a picture of risk that is far richer, more detailed, and dramatically more accurate.

This leap in analytical power moves the industry away from one-size-fits-all categories and toward true personalization. The result? Insurers can offer fairer pricing, issue policies in minutes instead of days, and confidently cover complex risks that were once off-limits.

From Static Data to Dynamic Insights

The real game-changer is AI's ability to make sense of huge volumes of diverse, unstructured data. While a human underwriter might juggle a few key variables, an AI model can assess thousands at once.

This isn't just about processing the usual information faster. It's about bringing new sources into the fold:

Traditional Data: Think application details, past claims history, and credit scores.

External Data: This includes public records, wider socio-economic trends, and even satellite imagery or geographic information systems (GIS) data for assessing property risk.

Real-Time Data: Information streaming from IoT devices is a huge one. This could be telematics from a car that tracks actual driving habits or smart home sensors that warn of a potential water leak.

By weaving all these threads together, AI creates a risk profile that reflects a person's or a business's real-world situation, not just the box they've been put in. For example, a driver who proves they are safe with a telematics device can earn a lower premium, no matter their age or zip code—a level of fairness that was nearly impossible with the old methods. Building a system like this requires a clear vision, which is why creating detailed Custom AI Strategy reports is such a critical starting point for any insurer looking to evolve.

AI doesn't just make underwriting faster; it makes it smarter and more equitable. It shifts the focus from "what group do you belong to?" to "what is your specific risk profile?"

Predictive Analytics: The New Standard in Risk Management

Beyond just pricing individual policies, predictive analytics are turning risk management from a reactive process into a forward-looking science. Insurers are no longer just waiting for claims to happen; they’re using data to see what’s coming around the corner and adjusting their strategies before it hits.

By analyzing climate data, for instance, a machine learning model can pinpoint regions with a growing risk of wildfires or floods. This allows insurers to rebalance their portfolios and, just as importantly, advise their policyholders on how to protect their property. This kind of foresight helps insurers manage their capital more effectively and stay stable, even when the market gets choppy.

This proactive stance also helps in sniffing out fraud right from the start. AI can spot inconsistencies or suspicious patterns in an application that a human underwriter might easily overlook, stopping a potential problem before it even begins. It’s a fundamental shift from simply insuring against things that have already happened to actively preparing for what the future might hold—a crucial step for any insurer wanting to thrive.

Streamlining Claims and Detecting Fraud with AI

For any policyholder, the claims process is the moment of truth. It's where the promise of protection meets reality. Historically, this journey was clunky and frustrating—a maze of paperwork, endless phone calls, and an agonizing wait for a resolution. When your customer is already dealing with a wrecked car or a flooded basement, a slow claims experience just pours salt on the wound.

But AI is flipping that script entirely.

Think about a typical car accident. What used to take weeks can now be handled in minutes. A policyholder can simply pull out their phone, snap a few pictures of the damage, and upload them through an app. Behind the scenes, computer vision algorithms instantly analyze the photos to estimate the repair costs. At the same time, Natural Language Processing (NLP) combs through the incident report, pulling out the crucial details and cross-referencing them with the policy.

This isn't just about moving faster. It's about delivering a smooth, transparent process that builds genuine trust. When you automate the simple, repetitive tasks, your human adjusters are free to focus their skills on the complex cases that demand real empathy and judgment.

The AI-Powered Claims Journey

The impact on operations is huge. The old, step-by-step manual process is being replaced by a smart, automated workflow.

Let’s look at the difference:

The Old Way (Weeks): A claim is filed. Someone manually keys it into the system. It gets assigned to an adjuster. The adjuster schedules an inspection, gathers documents, writes up a report, and finally approves a payment. Every single handoff is a potential bottleneck.

The AI Way (Minutes): The customer files the claim on a mobile app. AI instantly verifies their policy, analyzes the photos and documents they submitted, scans for any red flags, and can even approve an immediate payout for straightforward claims.

This incredible speed is possible because several AI technologies are working together. A solid AI requirements analysis is the first step to making sure these systems can handle the messy, real-world data that comes with insurance claims. It’s a point we’ve made before: starting with a well-defined problem like claims processing is one of the fastest ways to see a real return on your investment.

A Powerful Shield Against Fraud

While AI is creating an express lane for legitimate claims, it's also building a much stronger defense against fraud. Insurance fraud is a multi-billion dollar problem, and finding it has always been like searching for a needle in a haystack. Even the best human investigators can only review so much data.

Machine learning models, on the other hand, never get tired. They can be trained on mountains of historical claims data to spot the subtle patterns that scream "fraud."

An AI system can connect seemingly unrelated claims, identify inconsistencies in narratives, flag doctored images, and spot behaviors associated with known fraud rings—all in real time.

This is the real magic of AI in insurance claims. It gives honest customers a fast, painless experience while building an intelligent, ever-evolving defense against the bad actors. It's no wonder adoption is happening so quickly. A recent survey found that 90% of U.S. insurance companies are already looking into generative AI, with 55% already in early or full adoption, especially for making claims more efficient. You can discover more about these AI adoption trends and see how they are reshaping the industry. For modern insurers, AI is no longer a futuristic idea; it's an operational must-have.

Crafting a Proactive and Personal Customer Experience

Let's be honest: for a long time, dealing with an insurance company felt transactional, even a bit cold. You’d get a bill in the mail or hear from them only when something had gone wrong. That was pretty much it. AI is completely flipping that script. It’s making it possible for insurers to engage with customers on a personal, proactive level, turning a simple contract into a genuine partnership.

Think about the last time you needed a quick answer from a company. Instead of getting stuck in a phone tree or waiting for office hours, customers can now get help instantly. AI-powered chatbots and virtual assistants have become the new front line, offering 24/7 support. They can answer common questions, walk you through buying a policy, or help you get a claim started, all right when you need it. This immediate access smooths out the entire experience.

Personalization on a Massive Scale

But the real magic isn't just about faster answers—it's about deep personalization. By looking at everything from customer behavior and demographics to past interactions, AI systems can build a remarkably clear picture of each person's unique situation.

This understanding allows insurers to do some pretty smart things:

Suggest the Right Coverage: An AI might notice a customer just moved and proactively suggest renters insurance, or recommend better liability coverage for someone who just launched a small business. It’s about offering products that actually make sense for their life right now.

Provide Timely Safety Tips: Imagine getting an alert about an incoming hailstorm with practical advice on how to protect your car and home. This is AI at its best—using data to offer helpful, preventative advice.

Deliver Marketing That Actually Resonates: Gone are the days of one-size-fits-all campaigns. Insurers can now send messages that speak directly to an individual's needs, which goes a long way in building a stronger connection.

This isn't just about good service; it’s about transforming the insurer's role from a distant institution into a partner who is actively invested in your well-being. When you consistently show customers you're looking out for them, loyalty and retention naturally follow. You can see plenty of real-world use cases that show how this proactive approach is already paying off for innovative companies.

Building Better Services, Together

The smartest insurers know they can't build these new services in a bubble. The most successful strategies involve bringing customers directly into the development process. This approach, often called AI co-creation, is about working together to ensure the final tools truly solve real-world problems. By building with policyholders, not just for them, insurers get direct feedback and create solutions people will actually find useful.

This shift is about more than just technology; it’s about redefining the insurer’s role. AI provides the tools to move from being a reactive entity that just pays claims to a proactive partner that helps prevent them.

At the end of the day, this deep level of personalization makes the entire insurance experience feel more human. It tells customers that their provider gets them and is genuinely looking out for their best interests. When insurers nail this, they build a foundation of trust that can last for years—a massive advantage in a crowded market. For most companies, this journey starts with a solid plan, which is why expert AI strategy consulting is so crucial for mapping out these customer-focused goals.

Navigating the Challenges of Implementing AI

Adopting AI isn't as simple as flipping a switch; it introduces a whole new set of hurdles. While the potential rewards are huge, insurers have to get real about the risks involved. These aren't showstoppers, but they do demand careful planning and a solid strategy from day one.

Successfully bringing AI into an insurance business means tackling these obstacles head-on. You'll be dealing with everything from tricky regulations to the ethics of automated decisions. It's why getting expert AI strategy consulting at the very beginning is so important—it helps you see the problems before they grow into something unmanageable.

The Problem of Algorithmic Bias

One of the thorniest ethical issues you'll face is algorithmic bias. Here's the truth: an AI model is only as smart as the data it learns from. If your historical data reflects old, unfair practices—like redlining certain neighborhoods, for instance—your shiny new AI will learn those same biases and, worse, apply them at scale.

This can create some seriously unfair outcomes. Imagine an algorithm that automatically slaps higher premiums on people from specific zip codes or demographic groups, regardless of their personal risk. It’s not just bad for your brand and customer trust; it’s a direct route to major legal and regulatory trouble. Fixing this means constantly checking your models and committing to building fair, transparent systems.

Data Privacy and Regulatory Hurdles

AI models are data-hungry. To work well, they need massive amounts of information, which immediately sets off alarm bells for privacy and security. As an insurer, you're sitting on a treasure trove of sensitive personal data, and using that to train AI means you have to be absolutely watertight on regulations like GDPR.

The rules of the game are constantly changing, too. Governments and industry bodies are racing to create new guidelines for AI, which means compliance is a moving target. We're even seeing some insurers write broad AI exclusions into their liability policies, making the risk environment even more complex.

This isn't just about ticking compliance boxes. It requires a proactive, almost obsessive focus on strong data governance. For a closer look at managing these steps, feel free to explore our resources on effective AI implementation support.

High Costs and the Talent Gap

Let's be blunt: implementing AI is expensive. The upfront investment in technology, infrastructure, and just getting your data into shape can be a heavy lift. And it doesn't stop there. You have to factor in the ongoing costs of maintaining, updating, and monitoring these systems to keep them accurate and fair.

On top of the financial strain, there’s a serious people problem. There simply aren't enough data scientists, AI engineers, and machine learning experts to go around. Finding and keeping the right talent is a huge challenge for most insurers. As we explored in our AI adoption guide, building that expert team is a critical, and often costly, piece of the puzzle. It all points to the need for a phased, step-by-step approach that proves its value along the way, so you don't pour money down the drain.

Your Roadmap to Successful AI Integration

Jumping into AI without a clear plan is like setting sail without a map. You might be moving, but you almost certainly won't reach your intended destination. While the upside of using AI in insurance is undeniable, success doesn't just happen. It requires a deliberate, phased approach that turns a big vision into practical, value-driven steps.

Think of this roadmap less as a technical manual and more as a strategic guide. It’s here to help you start your AI journey on the right foot, ensuring your initiatives solve real business problems instead of just chasing the latest tech trend. Getting this right from the start is critical, which is why many leaders find that working with our expert team helps navigate these crucial early stages.

Phase 1: Define Your Strategy and Vision

Before you even think about technology, you have to answer a fundamental question: What are we actually trying to achieve? Your vision is your North Star. Are you trying to slash claims processing times, create hyper-personalized customer experiences, or sharpen your underwriting accuracy?

Your goals need to be specific and measurable. A vague goal like "improve efficiency" won't cut it. Instead, aim for something concrete, like "reduce manual data entry in claims by 40%."

To help crystallize these initial thoughts, you can use our free AI Strategy consulting tool to explore potential opportunities. This first step ensures every subsequent action is tied to a clear business outcome.

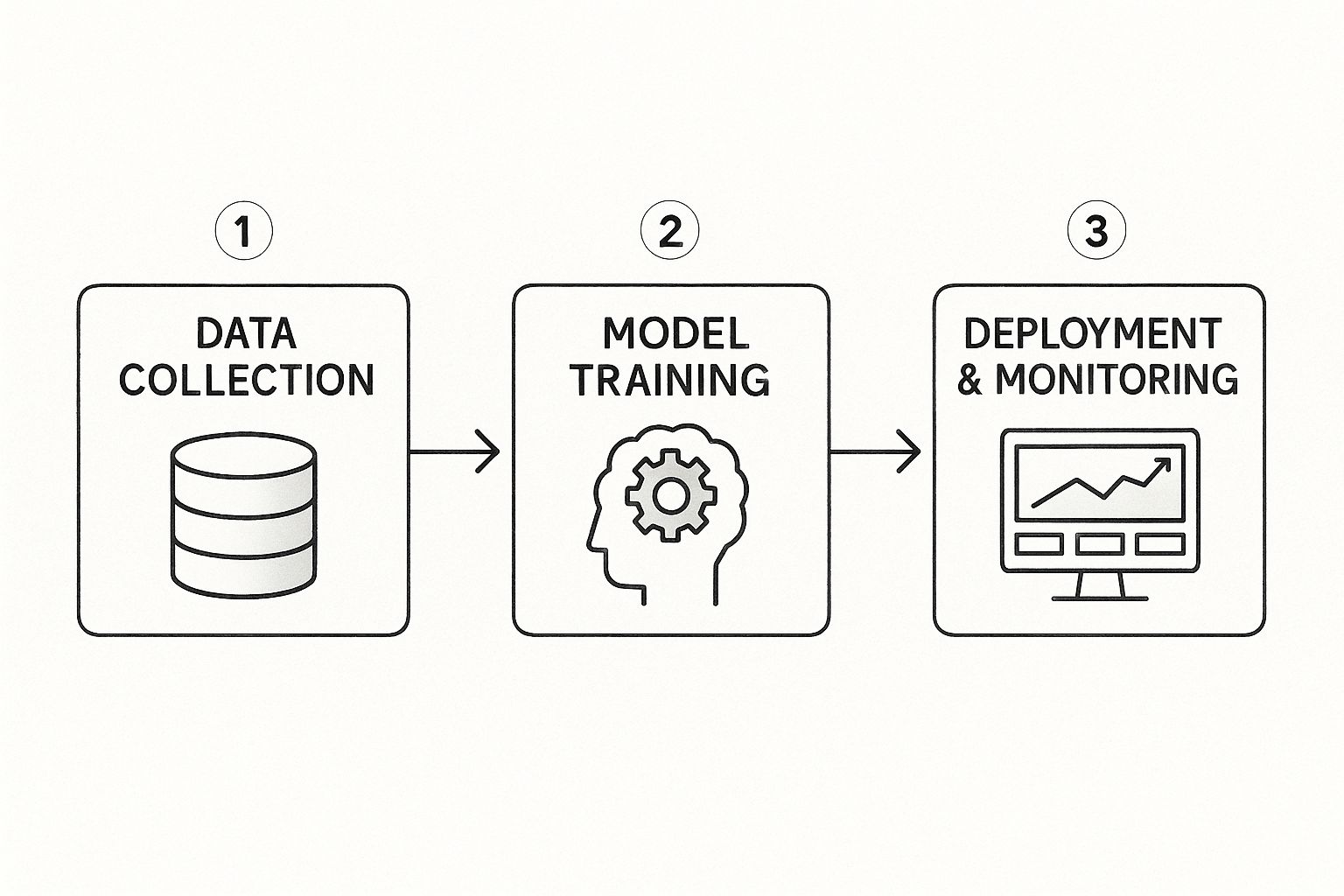

Phase 2: Assess and Prepare Your Data

AI models run on data—it's their fuel. If your data is messy, incomplete, or siloed across different systems, your AI projects will stall before they even get off the ground. This phase is all about getting your house in order.

You need to take a hard look at the quality, accessibility, and relevance of your current data. This usually involves:

Data Audit: Figuring out where your key data lives and who owns it.

Data Cleaning: Standardizing formats, filling in gaps, and fixing inaccuracies.

Data Governance: Setting up clear rules for how data is collected, stored, and used.

This is where the real work begins. The flow from raw data to a deployed AI tool is a logical progression, and it all starts with clean, reliable information.

As you can see, quality data is the foundation. Without it, even the most advanced models will fail to deliver useful, real-world results.

Phase 3: Start Small with Pilot Projects

Don't try to boil the ocean. Instead of attempting a massive, company-wide AI overhaul from day one, start with small, manageable pilot projects. The goal here is to prove value quickly, learn from your mistakes, and build momentum.

Pick a use case with a high potential for impact but a relatively low level of complexity. Good candidates often include automating a specific piece of the claims intake process or building a predictive model for a single line of business. These early wins give you the proof you need to get buy-in for larger projects down the road.

A successful pilot project acts as a powerful internal case study. It demonstrates tangible ROI and shows what's possible with AI, turning abstract concepts into concrete results that leaders can see and support.

Phase 4: Scale, Integrate, and Govern

Once you have a successful pilot under your belt, it's time to think bigger. This could mean expanding the solution to other departments or integrating it more deeply into your core systems. But scaling brings a new set of responsibilities, especially around governance and ethics.

As you expand, you must have clear frameworks for:

Model Monitoring: Continuously checking AI models for performance drift or bias.

Regulatory Compliance: Making sure your AI systems adhere to all industry regulations and privacy laws.

Ethical Guidelines: Defining your organization's principles for the responsible use of AI.

This journey is a strategic one. AI adoption really began to see systematic application around 2015-2016, and by 2023, 42% of American insurers were actively using it. Interestingly, 37% had consciously decided against it, showing that this is a strategic choice, not a blanket mandate. You can read the full analysis on insurance tech trends to get a better sense of this market maturity.

For a deeper dive into your own path, our Custom AI Strategy reports can provide the detailed insights you need to make these decisions with confidence.

Frequently Asked Questions About AI in Insurance

As insurance leaders start seriously looking at AI, a lot of practical questions naturally come up. It's one thing to talk about the technology, but another to understand what it actually means for your people and processes. Here are some straightforward answers to the questions we hear most often.

Will AI Replace Human Insurance Agents and Underwriters?

The short answer is no, but their jobs are definitely going to change. Think of AI as a powerful assistant, not a replacement. It's brilliant at handling the mountains of data and repetitive tasks that can slow down even the best professionals.

By automating the routine work, AI frees up your agents to become true advisors, using data-driven insights to guide clients through complex decisions and build lasting relationships. Likewise, underwriters can offload standard risk assessments to the machine, letting them focus their expertise on the tricky, high-value cases that require human judgment and experience. The goal is to elevate human roles, not eliminate them.

What Is the Best First Step for an Insurer to Adopt AI?

Don't start with the technology; start with a problem. The most common mistake is chasing AI as a shiny new toy. Instead, look at your business and pinpoint a specific, nagging issue. Where are the bottlenecks? Where are you losing money or frustrating customers?

Maybe it's the initial claims intake process, or a particular underwriting model that isn't performing well. A great first project is one that’s focused and where success is easy to measure. Once you have your target, you can assess if your data is clean and ready for a pilot. This approach delivers a tangible win, building momentum for bigger projects down the road. For more on strategy, you can find a lot of answers on our AI FAQ page.

How Can AI Lead to Fairer Insurance Outcomes?

This is a critical point. While we have to be vigilant about preventing algorithmic bias, AI actually has the potential to make insurance more fair, not less. It allows us to move beyond broad, often unfair demographic proxies.

A perfect example is telematics in auto insurance. Instead of relying heavily on generalized factors like age or zip code, pricing can be based on an individual's actual driving habits. The key is to build these systems responsibly. That means being transparent about how models work, constantly checking them for bias, and having a strong ethical framework in place to govern their use.

How Is Customer Data Kept Secure with AI Systems?

Security and privacy aren't afterthoughts—they have to be baked into the system from the very beginning. Protecting customer data is paramount. This involves standard but essential cybersecurity practices like robust data encryption, tightly controlled access, and frequent security audits.

Interestingly, AI can also be a powerful tool for security itself, actively monitoring systems to detect and flag suspicious activity that might signal a breach. Ultimately, every AI implementation must comply with strict data privacy regulations. It’s non-negotiable.

Ready to move from theory to action? Ekipa AI provides the tools and expert guidance to help you build a robust and actionable AI strategy. Start your journey by exploring our AI co creation platform today, or get in touch with our expert team to learn more.