How Can AI Help in Regulatory Compliance?

Discover how can AI help in regulatory compliance by automating tasks, reducing risks, and keeping your business ahead of complex legal changes.

At its core, AI helps with regulatory compliance by taking the overwhelming, manual slog of tracking, understanding, and following complex global rules and putting it on autopilot. It turns a reactive, error-prone task into a smart, proactive system. The result? Dramatically lower costs and a much smaller chance of facing crippling penalties, because potential problems get flagged long before they become actual violations.

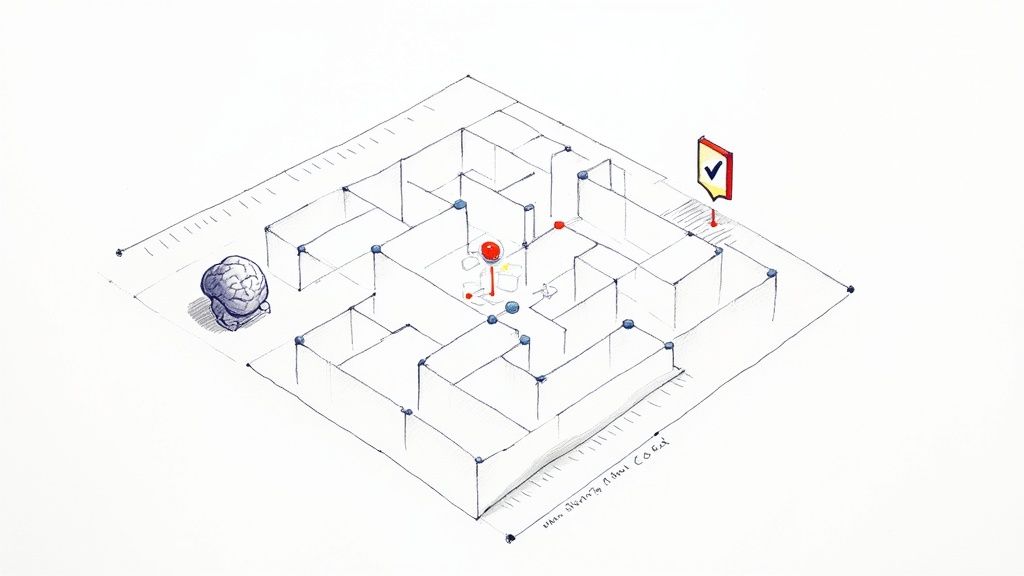

Navigating the Modern Compliance Maze

Trying to keep up with regulatory changes these days is like running through a maze that adds new walls every second. The sheer volume is mind-boggling. In the financial services world alone, companies are juggling between 12,000 and 40,000 different regulatory obligations, and that doesn't even count the hundreds of new alerts that pop up every single day. The old-school, manual approach to compliance just can't keep up. It's buckling under the weight.

This isn't just a headache for the legal department; it's a serious business risk. The money poured into manual compliance is staggering. Some teams burn through over $500,000 a year just on the time and effort spent manually tracking rules and documenting everything.

The Real-World Pain of Manual Compliance

Relying on people to do it all creates some major weak spots. The constant pressure on compliance teams leads to burnout, stress, and—inevitably—human error. And a single slip-up can have devastating consequences.

Here are just a few of the challenges businesses are up against:

- Sky-High Costs: Manual work is a black hole for resources, sucking up thousands of hours that could be spent on growing the business instead of just protecting it.

- The Constant Threat of Human Error: An overlooked update or a misinterpreted rule can easily lead to a compliance breach, triggering massive fines and damaging a company's reputation.

- The Inability to Scale: As a business expands or as massive regulations like GDPR or CCPA continue to change, manual systems simply can't keep up. This creates dangerous gaps where compliance falls through the cracks.

As you navigate this maze, it’s critical to remember the landscape is shifting under your feet, especially now that regulators confirm monitoring of AI use in the financial sector.

This reality demands a more intelligent way forward. We have to move away from a reactive, "check-the-box" mentality and toward a proactive, automated framework. This is where AI-driven Regulatory Technology (RegTech) is becoming a game-changer, acting as the essential guide through all this complexity. By looking to solutions built on AI co creation and guided by expert AI strategy consulting, businesses can start turning their compliance function from a pure defense mechanism into a real strategic advantage.

How AI Is Reshaping Regulatory Compliance

So, what does AI actually do for regulatory compliance on a day-to-day basis? Picture an always-on compliance expert who can read, understand, and act on massive volumes of regulatory data at a speed no human ever could. It’s what helps companies move from a reactive stance—scrambling to put out fires—to a proactive one where risks are nipped in the bud.

This fundamental shift is powered by a few core capabilities. AI takes over the monotonous, repetitive tasks like monitoring and reporting, which frees up your human experts to focus on strategy and judgment calls. It also uses predictive analytics to flag potential compliance gaps before they balloon into costly violations.

Perhaps most impressively, AI uses Natural Language Processing (NLP) to make sense of dense, convoluted legal documents in an instant. Think about the difference between a compliance officer manually sifting through a new 500-page regulation versus an AI that scans, comprehends, and cross-references it against your company's entire policy library in mere seconds.

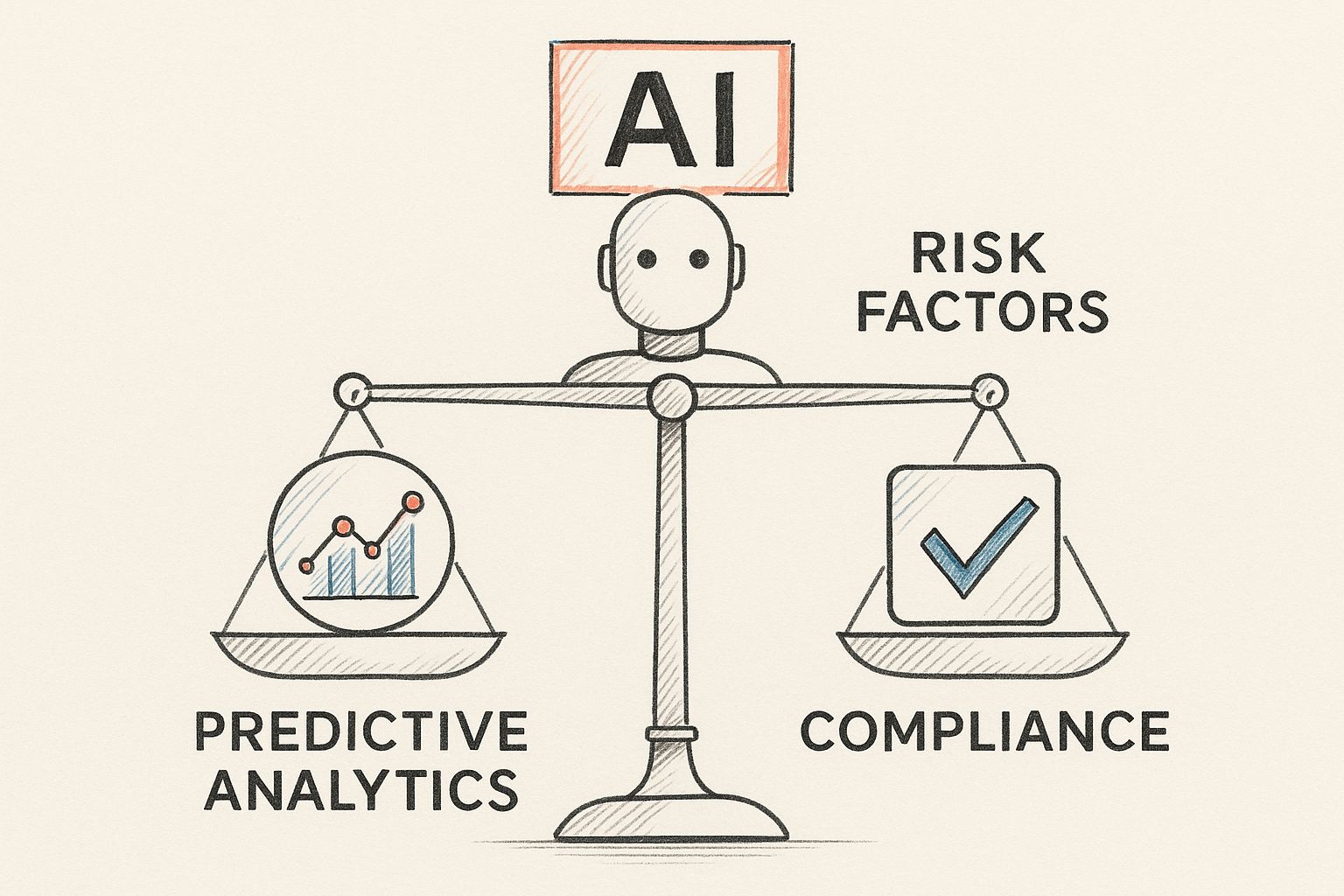

This visual shows how AI intelligently balances various risk factors using predictive analytics to keep a company on the right side of the law.

The image really drives home how AI doesn't just spot risks—it weighs them, allowing for a much smarter and more effective compliance strategy. To see how this applies in various industries, you can explore our collection of real-world use cases.

Automating the Grunt Work of Compliance

One of the first things teams notice when they bring in AI is its knack for handling high-volume, rule-based tasks with incredible speed and accuracy. Manual processes are slow and, worse, prone to human error. A single slip-up can lead to millions in fines. AI systems, on the other hand, don't get tired or distracted.

For example, they can:

- Scan for Regulatory Updates: AI-powered tools constantly watch global regulatory bodies for changes. These systems can filter out up to 95% of irrelevant alerts, letting your team focus only on what matters.

- Automate Reporting: Instead of spending a week pulling data, AI can generate complex compliance reports in minutes, ensuring every piece of information is consistent and accurate.

- Conduct Transaction Monitoring: In the financial sector, AI algorithms sift through millions of daily transactions to spot patterns linked to money laundering or fraud—a scale of analysis that's simply impossible for a human team.

Making Sense of Complex Legal Language

Regulatory language is notorious for being dense and difficult to parse. This is where AI’s NLP capabilities are a game-changer. NLP models are trained to read and understand legal text, pulling out key obligations, deadlines, and specific requirements buried in the jargon.

A great example is contract management. AI can automatically review thousands of vendor contracts to ensure they're all aligned with new data privacy laws like GDPR, a task that would take a legal team months to complete. The applications of AI in contract management show just how deep this impact goes.

The market is clearly moving in this direction. A PwC survey found that 82% of companies are planning to boost their investment in compliance technology, with a heavy emphasis on AI-driven tools. It’s not just about spending, either—71% of compliance officers believe AI will have a positive impact on their work, especially in risk detection and automated monitoring.

To give you a clearer picture, here's a quick breakdown of how AI is being put to work in the compliance field.

Key AI Capabilities in Regulatory Compliance

| AI Capability | Description | Impact on Compliance |

|---|---|---|

| Natural Language Processing (NLP) | Analyzes and interprets unstructured text from legal documents, regulations, and emails. | Decodes complex legal jargon, extracts key obligations, and flags non-compliant clauses in contracts. |

| Predictive Analytics | Uses historical data and machine learning to forecast potential compliance risks and future trends. | Moves teams from a reactive to a proactive stance by identifying high-risk areas before violations occur. |

| Robotic Process Automation (RPA) | Automates repetitive, rule-based tasks like data entry, report generation, and form submissions. | Frees up human experts for strategic work, reduces human error, and ensures consistency in routine tasks. |

| Machine Learning (ML) | Algorithms learn from data to identify patterns, detect anomalies, and improve accuracy over time. | Powers sophisticated fraud detection, anti-money laundering (AML) monitoring, and risk scoring systems. |

These capabilities are no longer just concepts; they are practical tools that are becoming the new standard for modern compliance departments.

Putting AI Compliance into Practice

It's one thing to talk about AI in theory, but where does the rubber meet the road? Let's move past the abstract and look at how AI is actually helping with regulatory compliance in the real world. The best place to see this in action is the financial sector, where the move from manual oversight to smart automation has been nothing short of a game-changer.

Think about a major bank. Every single day, millions of transactions flow through its systems. No human team could ever hope to keep up. This is where AI algorithms come in, effortlessly poring over that massive data stream. They're trained to spot the faint, complex signals of money laundering or fraud—patterns that would be almost impossible for a person to catch. It’s not just about doing things faster; it’s about achieving a level of precision that significantly cuts down financial risk and keeps the bank aligned with strict Anti-Money Laundering (AML) rules.

Beyond just watching transactions, AI also keeps a constant eye on the regulatory environment itself. When a government agency releases a new rule or tweaks an old law, these tools immediately flag the update. They then check it against the company's own internal policies, kicking off automated workflows to update documents and procedures. This means the organization is always prepared, never scrambling to catch up with new requirements.

From Manual Drudgery to Automated Precision

The before-and-after picture is stark. Across every area of compliance, we see a clear shift away from slow, reactive, and mistake-prone manual work. In its place, companies are adopting proactive, data-driven strategies that are simply more effective.

Here are a few concrete examples of how this plays out:

- Trade Surveillance: Before, teams at investment firms would spend countless hours manually reviewing enormous logs of trading activity, usually long after a potential violation occurred. Now, AI models watch trades in real-time, instantly flagging suspicious behavior that could point to insider trading or market manipulation.

- Data Privacy (GDPR/CCPA): Manually finding and managing personal data across a large organization is a nightmare. AI tools automate this by scanning documents, databases, and emails to identify and classify personally identifiable information (PII). This ensures data is handled correctly under strict privacy laws like GDPR.

- Regulatory Reporting: AI can handle the entire reporting process—from gathering and checking the data to actually generating the final reports. This dramatically shortens the time it takes to prepare submissions for regulations like the Home Mortgage Disclosure Act (HMDA) and slashes the risk of expensive errors.

The real secret sauce here is consistency. An AI model doesn't get tired or distracted. It applies the exact same rules and logic to the millionth transaction of the day as it did to the first, eliminating the human error that’s unavoidable in high-stakes compliance work.

This fundamental change allows compliance professionals to stop drowning in spreadsheets and start focusing on what they do best: high-level strategy, risk analysis, and policy creation. Nailing this transition is key, and expert AI implementation support can make all the difference in getting it right. By bringing AI into their day-to-day operations, companies aren't just checking a compliance box—they're building a smarter, stronger, and more resilient business from the ground up.

The Strategic Edge of AI in Compliance

Thinking about AI for compliance as just a technology upgrade is missing the bigger picture. It's a strategic move that can transform what's traditionally been a cost center into a real source of business value. The benefits aren't just about saving a bit of time; they fundamentally reshape how a company handles risk, builds trust, and ultimately, gets ahead of the competition.

AI brings a level of accuracy to the table that humans, no matter how skilled, simply can't match over the long haul. It cuts down on the kind of costly errors that lead to eye-watering fines. We've all seen how manual processes can crack under pressure, especially when teams are stretched thin. In fact, organizations stuck with manual compliance see 3.2 times more violations than those that have embraced automation. AI, on the other hand, is relentlessly consistent, ensuring that every monitoring task, report, and policy update is handled with precision. This isn't just about avoiding penalties; it's about building a rock-solid reputation with customers and partners who need to know you're a secure and dependable business.

From Manual Grind to Strategic Insight

The financial upside of automating compliance work is almost immediate. AI takes on the grunt work—sifting through endless regulatory alerts, mapping out new obligations, and piecing together reports. This frees up your compliance experts to do what they do best: think strategically.

Instead of getting lost in spreadsheets, your team can finally focus on interpreting complex regulatory shifts and advising the business on what's coming next. This turns the compliance function from a reactive watchdog into a proactive business partner.

And let's be clear, having a strong AI governance plan is no longer optional. With regulations like the EU’s AI Act—which some are calling 'GDPR on steroids'—the pressure is on. This act introduces tough new rules for AI transparency, bias testing, and accountability. Getting it wrong could mean fines as high as €35 million or even more, making a proactive approach to AI governance an absolute must. For a deeper dive, you can find more insights on AI compliance for 2025 and beyond on ispartnersllc.com.

A Tangible Return on Investment

A solid AI framework, like the kind detailed in a Custom AI Strategy report, gives you a clear roadmap to capture these benefits. Having real-time monitoring, for instance, provides a massive competitive advantage. It lets you pivot instantly when new rules drop and enter new markets knowing you're fully covered.

The difference between the old way and the new way is stark. The table below lays out just how much of an impact an AI-powered approach can have.

Traditional vs AI-Powered Compliance

| Metric | Traditional Compliance | AI-Powered Compliance |

|---|---|---|

| Accuracy Rate | Prone to human error; some manual data tasks have error rates as high as 14.6%. | Nears perfection in automated tasks, dramatically cutting the risk of violations. |

| Operational Costs | High, driven by intensive manual labor. Some teams spend over $500,000 a year. | Significantly lower thanks to automated repetitive work and smarter use of people. |

| Risk Detection | Reactive. Problems are often found only after they’ve happened, usually during an audit. | Proactive. Uses predictive analytics to spot potential risks before they turn into violations. |

| Speed & Efficiency | Slow and clunky. A single regulatory update can take hours or even days to analyze. | Real-time. Analysis and reporting happen in minutes, not hours. |

Looking at these numbers, it's clear that AI doesn't just make compliance easier—it makes it smarter, faster, and far more effective.

Charting Your Course: How to Actually Implement AI in Compliance

Bringing AI into your compliance framework isn't just about flipping a switch on some new software. It’s a thoughtful process that, when handled correctly, can turn your compliance department from a cost center into a real strategic advantage. The journey starts with a simple question: What does success look like for us?

This is where the real work begins. You have to connect your compliance goals to concrete business results. Getting expert help from an AI strategy consulting firm can make all the difference here, as they can help pinpoint your biggest regulatory headaches and operational bottlenecks to build a strategy that actually works. It's a critical step, yet one that most companies are skipping.

The numbers are pretty stark. A recent report found that a staggering 80.2% of organizations worldwide feel they aren't ready for AI regulatory compliance. It gets worse: only 6.4% have an advanced AI security strategy in place. This tells us there's a massive gap between wanting to use AI and having a plan to do it safely. You can learn more about these findings from the 2025 AI Risk & Readiness Report.

First, Get Your Data House in Order

Before you even think about algorithms, you have to look at your data. AI is a powerful tool, but it's completely dependent on the quality of the information you feed it. This means your first job is to get your compliance data cleaned up, organized, and properly structured so that an AI can make sense of it.

Think of it like cooking a gourmet meal. You wouldn't just throw random, unwashed ingredients into a pot and expect a masterpiece. The same logic applies here. If your data is a mess, your AI’s insights and risk alerts will be unreliable at best.

Picking the Right Tools for the Job

With a solid data foundation, you can start looking at technology. The market generally offers two paths: you can buy an off-the-shelf solution or build a custom model from scratch. Pre-built tools can get you up and running quickly, but a custom solution, often built through a collaborative AI co creation process, is designed to fit your unique challenges like a glove.

To figure out which way to go, ask yourself a few questions:

- How complex are our problems? Are we just tracking regulatory changes, or do we need something that can analyze millions of transactions in real-time?

- What can our team handle? Do we have the in-house talent to build and maintain a custom AI, or does a vendor-managed tool make more sense?

- Will this scale with us? The tool we choose today needs to handle more data and tougher regulations tomorrow.

If you need a detailed roadmap, a Custom AI Strategy report can map everything out, while an interactive AI Strategy consulting tool can help you weigh your options on the fly.

Don't Forget the Human Element

Ultimately, the success of any AI implementation comes down to your people. These tools are meant to be a co-pilot for your compliance experts, not a replacement. You have to invest in training your team to work with their new AI partner.

This means teaching them how to read the AI's outputs, investigate the exceptions it flags, and free up their own time for the complex, judgment-based work that only a human can do. When you empower your team this way, the technology becomes more than just another tool—it becomes a core part of your compliance culture.

Building a Compliance Strategy That Lasts

Adopting AI for compliance isn't a "set it and forget it" kind of deal. It’s a continuous process. We're already seeing the next wave on the horizon—think generative AI drafting initial compliance reports or all-in-one "Compliance as a Service" platforms becoming the industry norm.

The right way to think about this shift is to see AI as a powerful partner, one that enhances the irreplaceable expertise of your human team.

AI is brilliant at the grunt work—the repetitive, data-heavy lifting that can bog down even the best compliance professionals. By taking that off your team's plate, you free them up to do what they do best: focusing on high-level strategic thinking, nuanced risk analysis, and interpreting the gray areas of regulation that a machine just can't handle. That’s the heart of a truly future-proof strategy.

Evolving with AI

Creating a resilient compliance framework means you have to lean into this evolution. It demands a real commitment to learning and adapting as you go. As AI models get smarter and more capable, your own strategies have to keep pace.

The real win is creating a symbiotic relationship. Technology delivers the speed and the data-driven insights, while your human experts provide the critical judgment, context, and ethical oversight that regulations demand.

When you invest in an intelligent compliance framework today, you're doing more than just putting out fires. You’re building a more efficient, trustworthy, and agile organization that’s ready for whatever the regulators throw your way next.

To start shaping your own forward-thinking approach, connect with our expert team and see how a custom strategy can prepare you for the future.

Frequently Asked Questions

Got questions about putting AI to work for regulatory compliance? You're not alone. Here are a few of the most common ones we hear from organizations figuring out their next steps.

Is AI Really Reliable Enough for Critical Compliance Tasks?

It's a fair question, and the answer is yes—but with an important condition. When set up the right way, AI is a powerhouse for sifting through massive datasets without getting tired or making the simple mistakes that even the best human teams can make. Think of it as your most diligent, tireless assistant.

That said, its reliability hinges on a few key things: clean, high-quality data to learn from, proper training for the AI model, and ongoing human supervision. The sweet spot isn't AI working in a silo; it's a partnership. AI tackles the heavy lifting and repetitive work, while your human experts step in to validate the results and handle the tricky, nuanced situations. It’s about making your team smarter, not replacing them.

What’s the Very First Step to Adopting AI for Compliance?

Before you even think about specific tools, you need to look inward. The first move is always to take a hard, honest look at your current compliance processes. Where are the bottlenecks? What tasks are eating up the most time and causing the most headaches?

Running an AI requirements analysis can bring a lot of clarity here, helping you pinpoint exactly where automation could make the biggest difference—whether that’s in monitoring transactions or just keeping up with new regulations. A great strategy is to start small with a pilot project that solves a real, high-impact problem. This proves the value quickly and gets everyone on board before you go bigger.

Can AI Help Us Keep Up with Brand-New Regulations?

Absolutely. In fact, it’s becoming essential. Take something like the EU AI Act—it’s a whole new ballgame. AI tools are perfectly suited to help you navigate these kinds of rules. They can automatically log where your data comes from, keep an eye on your models to check for bias, and maintain the transparent records needed to prove you're playing by the rules.

As we explored in our AI adoption guide, a strong governance framework is the foundation for meeting these new standards. For more answers to common questions, our comprehensive AI compliance FAQ page has you covered.

Ready to build a smarter, future-proof compliance strategy? Ekipa delivers tailored AI roadmaps in 24 hours, turning your compliance challenges into strategic advantages. Get your custom AI strategy today.